In this article, we are going to cover the impact on the interest cost based on your loan tenure.

You pay more interest on your loans based on the loan tenure you choose. Longer the tenure, the more you pay. Let us take an example. Mr. Jack wants to avail home loan / home mortgage of Rs 50 Lakhs. He approaches the banking executive seeking for financial assistance. Banking executive checks his eligibility based on his salary and offers him three options with tenure ranging from 10 years to 30 years.

EMI installment will be very less if you choose 30 years, however you would eventually end up paying more interest. Usually bank prefers long tenure loans as they would earn more money. If you don’t agree, try asking home loan for 2 years 🙂

Now, let us look at an illustration as to how the interest amount changes on choosing these 3 options.

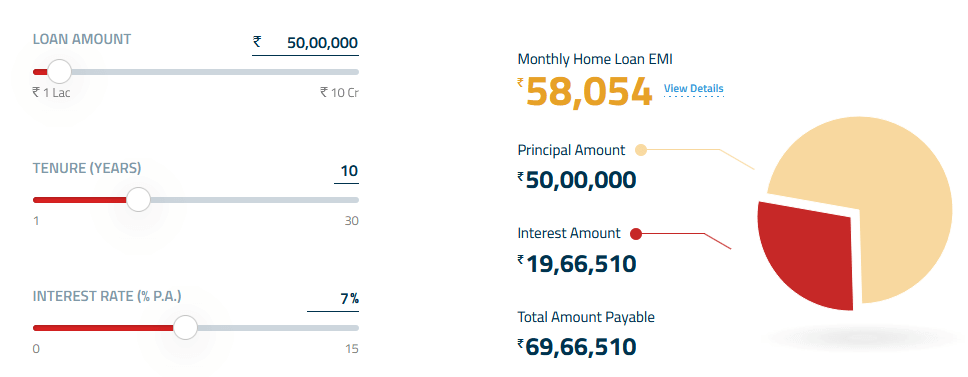

Case 1: Tenure: 10 Y

In this case, Mr. Jack would pay Rs: 58,054 as monthly EMI. In total, he would pay Rs. 19,66,510 as interest.

Case 2: Tenure: 20 Y

In this case, Mr. Jack would pay Rs: 38,765 as monthly EMI. In total, he would pay Rs. 43,03,589 as interest.

Case 3: Tenure: 30 Y

In this case, Mr. Jack would pay Rs: 33,265 as monthly EMI. In total, he would pay Rs. 69,75,446 as interest. This is 39% higher than the principal amount of 50 Lakhs.

Naturally if someone offers you these plans, without showing the interest illustration, we would tend to choose the option with least monthly EMI. Hope this article helps you to choose the correct loan tenure.

We mentioned home loan as 7% just for an illustration. Kotak bank is offering home loan at 6.75% and you can find the details on the post here. For checking the home loan rates for various other banks and nbfc’s, please check here.