In this article, we are going to show SIP results for stocks such as Maruti, Hero honda, DCB bank, HDFC bank and Eicher motors. SIP start date for all the stocks listed here is Feb 2018 and the post was published 04-Jan-2021.

This comparison will help you to make informed decisions as this period between Feb 2018 and Jan 2021 includes a steep fall and steep raise in stock prices. The fall was so steep such that most of the stocks were down by 50%. In other words, this is the best period to measure SIP performance. However, good companies like Nestle and Asian paints did not fall as much as other stocks.

SIP requires discipline and you need to invest at regular interval to create wealth in long term. For example, Systematic Investment Plan can be daily, weekly, monthly or even quarterly, however in this article results are provided for monthly SIP.

Similar to investments on stock through systematic way, one can also invest in mutual funds in a similar approach. While selecting stocks for systematic investment, one should select quality stocks. Quality stocks are those of companies with higher sales, no debt with sustainable earnings and run by a good management. However, no matter how good a company is, 3 years is too less period to judge the equity performance.

To conclude, SIP is a disciplined approach to ride the volatility. There is no guarantee that you will see the same performance in future like the examples shown below, however with the help of Financial Advisors you may beat the inflation and create wealth in the long run. Above all, one should review the financial situation of the company at least every quarter.

SIP results for Hero Moto and Bajaj Auto

This post shows the sip results for Hero Moto vs Bajaj Auto for a period of 3 years. SIP start date is Feb 2018. Please like and share this post with your friends.

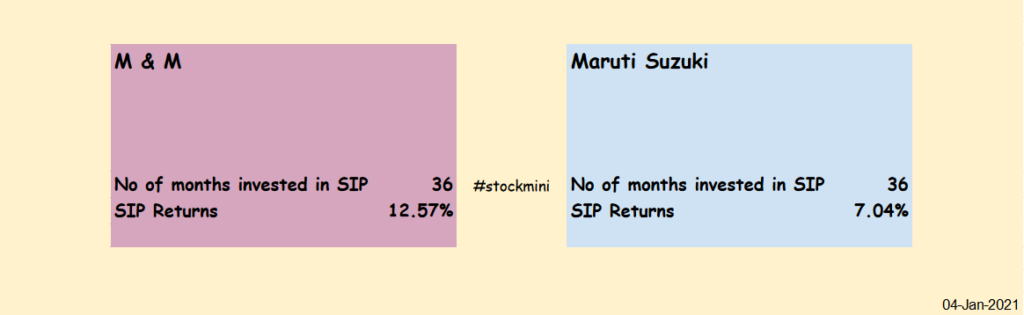

SIP results for M&M and Maruti

This post shows the sip results for M&M and Maruti for a period of 3 years. Please like and share this post with your friends.

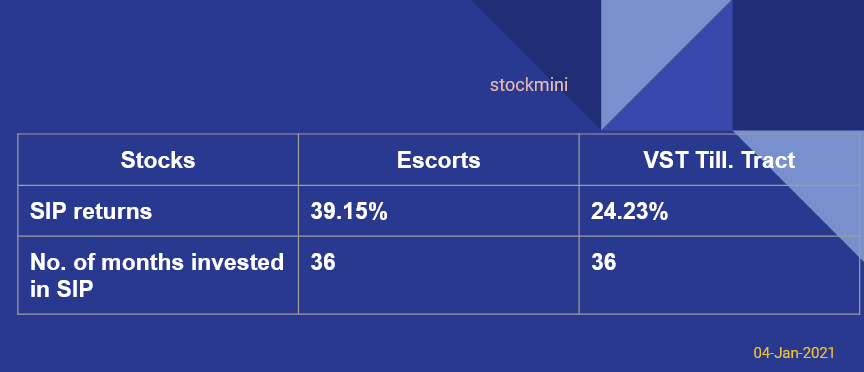

SIP results for Escorts and VST

The Escorts Group is among India’s leading engineering conglomerates operating in the high growth sectors of agri-machinery, construction and material handling equipment, railway equipment and auto components. VST Tillers Tractors Ltd. was promoted by VST Motors as a joint venture with Mitsubishi Heavy Industries Ltd, Japan. As a result, company is now the largest manufacturer of Power Tillers in India. This post shows the sip results for Escorts vs VST for a period of 3 years.

SIP results for Ashok Leyland and Eicher Motors

In this post, we have published SIP results for Ashok Leyland and Eicher Motors. You can view SIP results for other stocks in the link. Please like and share this post with your friends. Auto sectors are still recovering however stocks such as Eicher Motors and Ashok Leyland managed to deliver good returns.

SIP results for Force Motors and SML Isuzu

This post shows the sip results for Force Motors vs SML Isuzu for a period of 3 years.

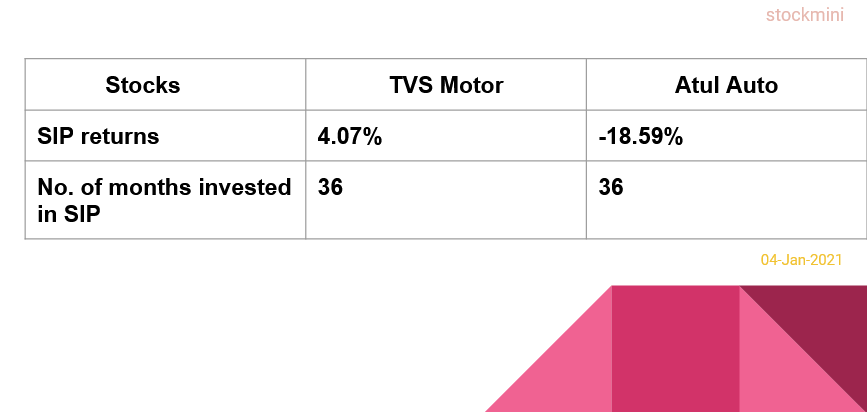

SIP results for TVS Motor and Atul Auto

This post shows the SIP results for TVS Motor and Atul Auto for a period of 3 years. Please like and share this post with your friends.

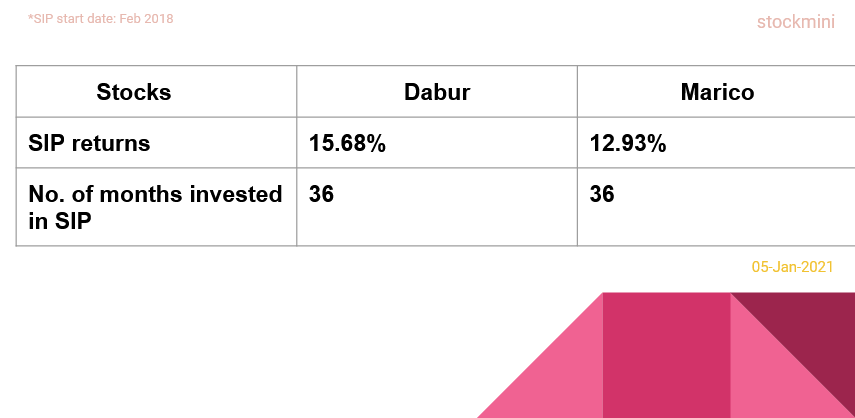

SIP results for Dabur and Marico

This post shows the SIP results for Dabur and Marico for a period of 3 years. Please like and share this post with your friends. Dabur is currently trading at a PE of 55.4 while Marico’s PE is at 45.5.

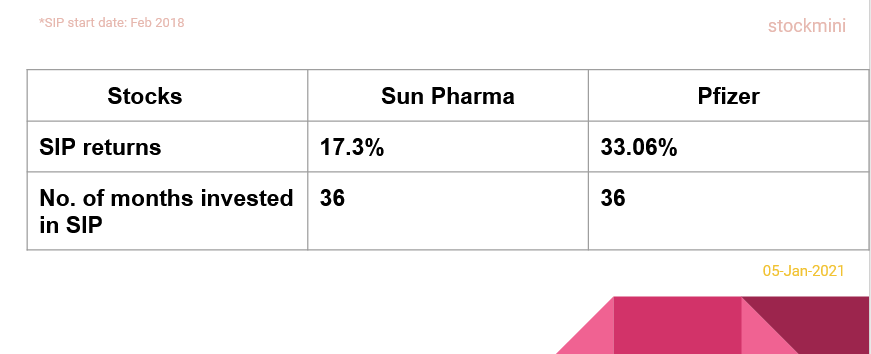

SIP results for Sun Pharma and Pfizer

This post shows the SIP results for Sun Pharma and Pfizer for a period of 3 years. Please like and share this post with your friends. You can view SIP results for other stocks in the link.

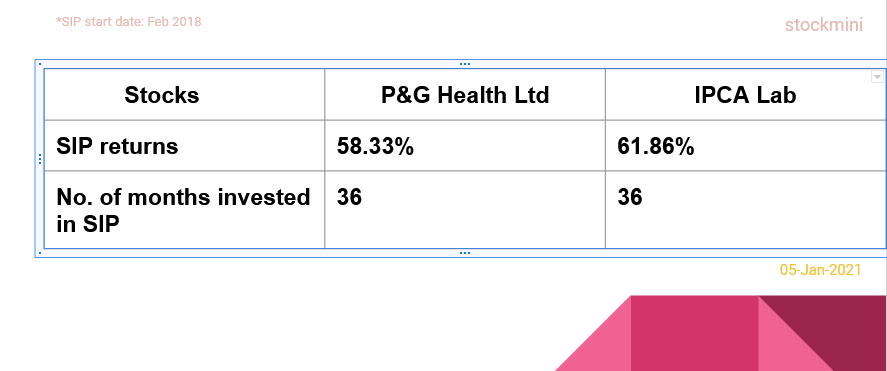

SIP results for P&G Health and IPCA

This post shows the SIP results for P&G Health and IPCA for a period of 3 years.

L&T Infotech vs Persistent

SIP results for L&T Infotech and Persisten are shown below.

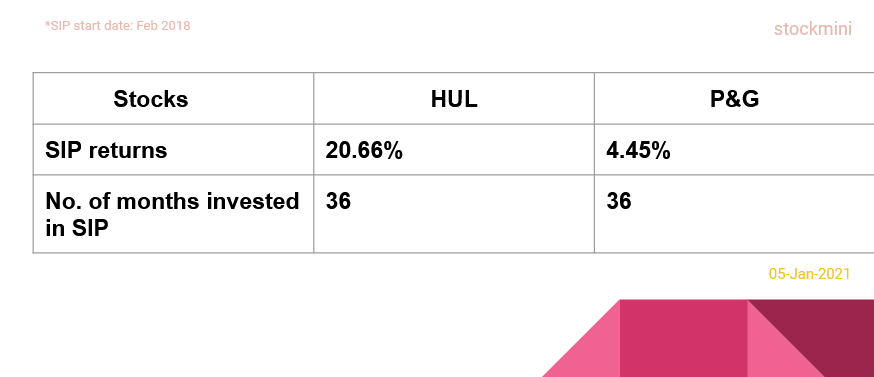

HUL and Procter vs Gamble.

HUL and P&G are top mnc companies with a good dividend track record. Both these companies always trade at a premium. Therefore, SIP is the best approach to invest in such companies whose valuations are always high.

HCL vs Tech Mahindra

HCL and Tech Mahindara, like any other IT companies delivered decent returns. However some of the small cap IT companies and Mid cap IT companies have delivered even more better returns.

HDFC Bank vs ICICI Bank

HDFC bank and ICICI banks are leaders in the private banking sector and delivered a very decent returns.

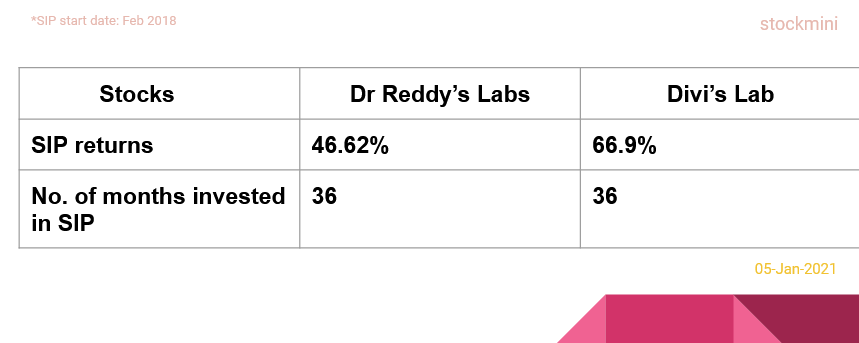

Dr Reddy and Divis

Pharmaceutical as a sector has splendid run in the recent times. For example, Dr Reddy delivered 46.62% return and Divis lab delivered 66.9% returns in the said period.

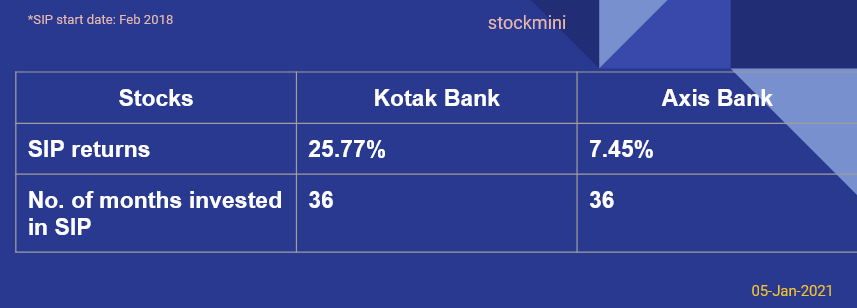

Kotak vs Axis Bank

Kotak and Axis bank are some of the good private sector Banks.

Colgate vs Emami

In addition to Hindustan Unilever, Colgate and Emami aslo belong to FMCG sector.

Aarti Drugs vs Suven Life

Aarti drugs sales growth in the past 10 years is at 14%. Both Aarti drugs and Suven life has delivered spectacular SIP results in the past three years.

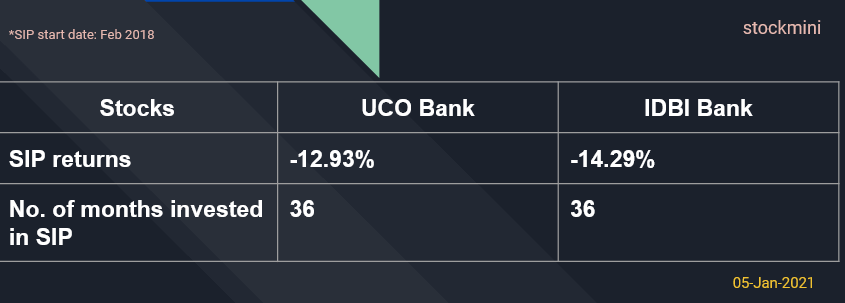

IDBI vs UCO bank

Both the stocks did not perform in the last 3 years.

Wipro vs Mphasis

IT sector has delivered in the last 3 years.

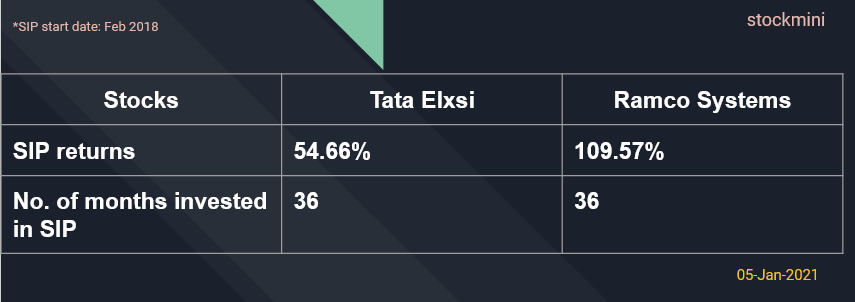

Tata Elxsi vs Ramco Systems

Ramco systems delivered 109.57% CAGR. This a spectacular performance considering the covid situation where our other investments are still struggling to perform.

Infosys vs TCS

Both Infosys and TCS belong to IT sector. Infosys has delivered a spectacular return of 42.38% while TCS has delivered 30.32%.

South Indian Bank vs Karnataka Bank

South Indian Bank in India and provides retail and corporate banking, para banking activities such as debit card, third party financial product distribution, in addition to Treasury and Foreign Exchange.

City union vs DCB bank

DCB bank is yet to recover from the recent fall and it is still under performing its peers.

IndusInd bank vs RBL Bank

Both these banks are private banks yet they delivered only negative returns, however some of its peers shuch as hdfc bank and Kotak are recovered and delivered good returns.

Indian Bank vs Bank of India

Indian bank has a given a negative return of 18.94% while Bank of India has also return negative return of 17.39%. To sum up, SIP can under perform, if the selected instrument is on multi year down trend and is well explained in the article mentioned here.