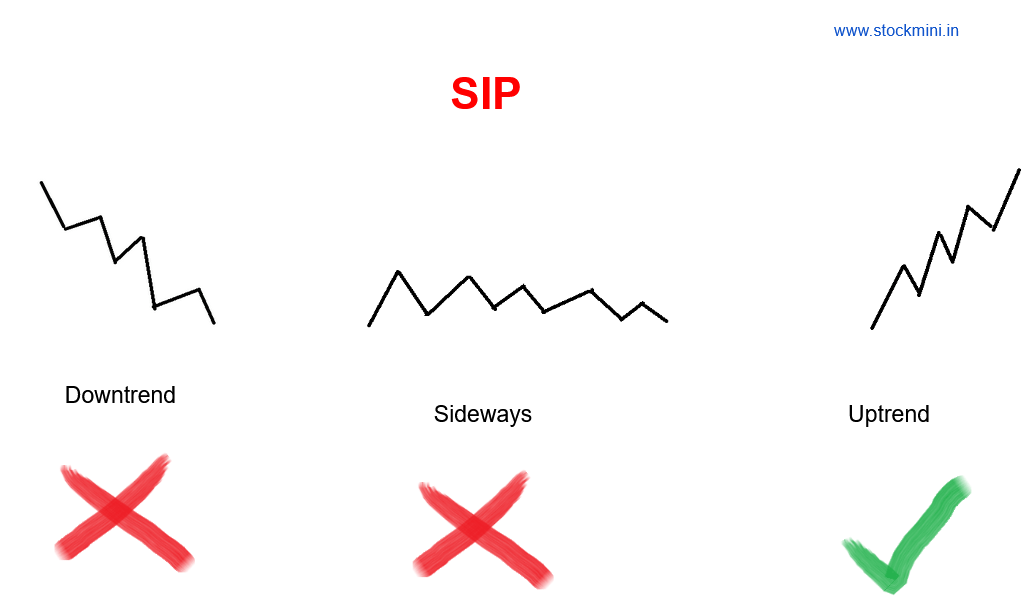

In this article we are going to see some examples on how SIP under performs when the underlying is on downtrend.

Investors tend to invest in stocks through SIP thinking that they can make money in any market conditions. But it doesn’t work that way. For the SIP to work, investors should do some research and select stocks accordingly. Even good quality stocks can under perform for years.

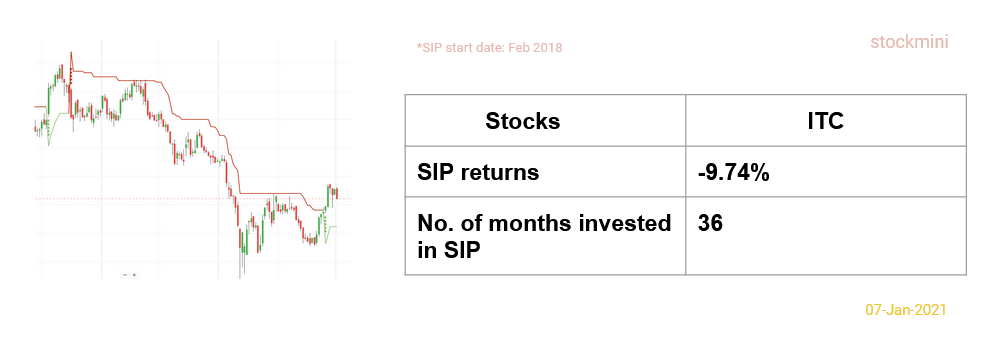

Three year SIP results for ITC

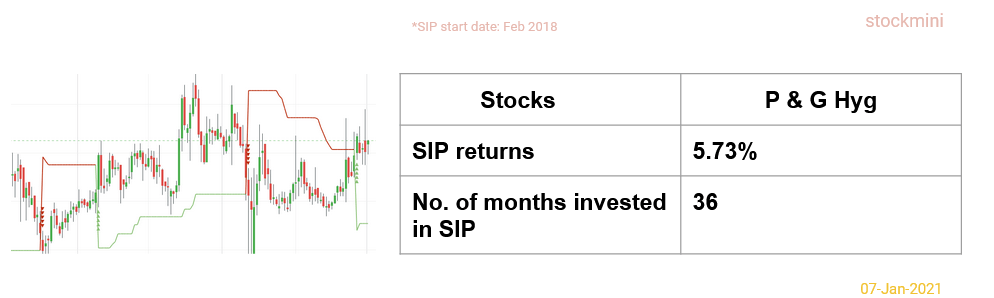

Three year SIP results for P & G Hyg.

Three year SIP results for Asian Paints.

SIP results for commonly invested stocks can be viewed here. In the past three years, SIP on nifty index has given a reasonable return. Will it continue ? Please provide your views on the comments section.

[…] You can also look at the SIP results of Asian paints here. […]

[…] Indian bank has a given a negative return of 18.94% while Bank of India has also return negative return of 17.39%. To sum up, SIP can under perform, if the selected instrument is on multi year down trend and is well explained in the article mentioned here. […]